How to Calculate Payback Period in Excel

Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. We explain its formula, how to calculate, example, advantages, disadvantages & differences with ROI. In case the sum does not match, then the period in which it lies should be identified. After that, we need to calculate the fraction of the year that is needed to complete the payback. On the other hand, Jim could purchase the sand blaster and save $100 a week from without having to outsource his sand blasting.

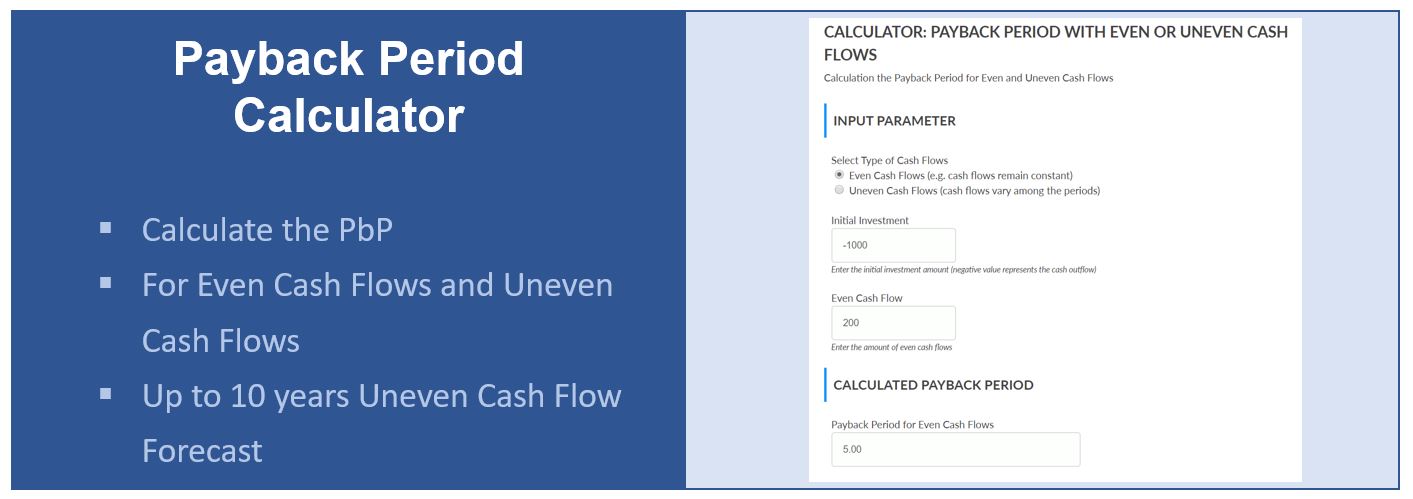

How to Calculate the Payback Period

Jamie Haenggi, president of ADT Solar, told CNET an average payback period in the US is six to 12 years, with most households leaning closer to the latter. Solar panels can save you a lot of money on electricity, and might even make you money if you can sell energy back to the grid. The above payback period formula article notes that Tesla’s Powerwall is not economically viable for most people. As per the assumptions used in this article, Powerwall’s payback ranged from 17 years to 26 years. Considering Tesla’s warranty is only limited to 10 years, the payback period higher than 10 years is not idea.

How to Calculate Percentage Change on Excel

The management of Health Supplement Inc. wants to reduce its labor cost by installing a new machine in its production process. For this purpose, two types of machines are available in the market – Machine X and Machine Y. Machine X would cost $18,000 where as Machine Y would cost $15,000. Cumulative net cash flow is the sum of inflows to date, minus the initial outflow. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Investors might also choose to add depreciation and taxes into the equation, to account for any lost value of an investment over time.

Advantages and disadvantages of payback method:

By following these simple steps, you can easily calculate the payback period in Excel. Using Excel provides an accurate and straightforward way to determine the profitability of potential investments and is a valuable tool for businesses of all sizes. But there are a few important disadvantages that disqualify the payback period from being a primary factor in making investment decisions. First, it ignores the time value of money, which is a critical component of capital budgeting.

Payback Period and Capital Budgeting

- If opening the new stores amounts to an initial investment of $400,000 and the expected cash flows from the stores would be $200,000 each year, then the period would be 2 years.

- It is a rate that is applied to future payments in order to compute the present value or subsequent value of said future payments.

- Since most capital expansions and investments are based on estimates and future projections, there’s no real certainty as to what will happen to the income in the future.

- The payback period is the amount of time for a project to break even in cash collections using nominal dollars.

- Maybe you just want to help the environment and aren’t worried about the costs, but «folks are interested in the resilience aspect and the economic aspect, as well,» she said.

The purchase of machine would be desirable if it promises a payback period of 5 years or less. Tools such as net present value (NPV) and internal rate of return (IRR) offer a more comprehensive view of investment profitability, but they are more complex to calculate. It’s important to note that while payback period is an essential metric, it’s not a comprehensive measure of investment profitability.

Payback Period: Formula and Calculation Examples

The payback period is the amount of time it will take to recoup the initial cost of an investment, or to reach its break-even point. Therefore, the payback period for this project is 5 years, which means that it will take 5 years to recover the initial $100,000 investment from the annual cash inflows of $20,000. Payback period is a fundamental investment appraisal technique in corporate financial management. It is a measure of how long it takes for a company to recover its initial investment in a project.

In most cases, this is a pretty good payback period as experts say it can take as much as 7 to 10 years for residential homeowners in the United States to break even on their investment. «It depends on what is motivating the household to make the decision to [install] solar,» Jones-Albertus said. Maybe you just want to help the environment and aren’t worried about the costs, but «folks are interested in the resilience aspect and the economic aspect, as well,» she said. Calculating your potential payback period will depend on a lot of variables. Before you invite a crew of solar installers over, you’ll want to understand when — or if — the panels will start to pay for themselves. Now that you have all the information, it’s time to set up your Excel spreadsheet.

Conceptually, the payback period is the amount of time between the date of the initial investment (i.e., project cost) and the date when the break-even point has been reached. Investors may use payback in conjunction with return on investment (ROI) to determine whether or not to invest or enter a trade. Corporations and business managers also use the payback period to evaluate the relative favorability of potential projects in conjunction with tools like IRR or NPV.

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. First, we’ll calculate the metric under the non-discounted approach using the two assumptions below. Thus, the project is deemed illiquid and the probability of there being comparatively more profitable projects with quicker recoveries of the initial outflow is far greater.

In essence, the shorter the payback an investment has, the more attractive it becomes. Determining the payback period is useful for anyone and can be done by dividing the initial investment by the average cash flows. It is a rate that is applied to future payments in order to compute the present value or subsequent value of said future payments. For example, an investor may determine the net present value (NPV) of investing in something by discounting the cash flows they expect to receive in the future using an appropriate discount rate. It’s similar to determining how much money the investor currently needs to invest at this same rate in order to get the same cash flows at the same time in the future. Discount rate is useful because it can take future expected payments from different periods and discount everything to a single point in time for comparison purposes.

Comentarios recientes